CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

Once you decide to take control of your finances, it can be a freeing feeling. Saving money takes time and it requires a lot of patience, but if you can budget and plan for it accordingly, you can make a huge lifestyle change. These printable budget planners can help you do just that, but without any added stress. Instead you can feel a little more organized while saving money in the best way possible.

Whether you need something just to get you back on track or you need a monthly budget planner to keep you on the right path in saving and spending an appropriate amount of money, these printable budget planners can help you out. You might also need a planner to help you take care of some of that pesky debt and those are available too. If there is some aspect of your budget that you need to get under control, there is likely a budget planner for you.

What is a Budget Planner?

A budget planner may be a worksheet or a notebook. It’s a tool to help you design and stay on your budget. A budget planner allows you to see how your money’s spent each month. It can also help you reduce or avoid debt.

Choose a Printable Budget Planner That Works for You

Before you can choose the right printable budget planner, you’ll need to determine a budgeting system that works for you. There are many kinds of budget systems you can use to keep your finances in order. When you’ve found the right system, then you can go on to pick the right budget printable budget planner.

The budget planner should be easy to use with your system and make it easy to review your numbers, where you are in spending, and more.

The Benefits of Using a Printable Budget Planner

Creating a budget isn’t much fun; however, it’s necessary to ensure your finances are in good shape. There are several benefits that go with using a printable budget planner, including:

See where your money’s going: it’s easy to get into the habit of swiping your debit or credit cards without thinking about it. However, with a budget planner, you become more aware of what you’re spending. It also allows you to see where it may be necessary to cut back. And a budget planner can help you meet your goals, such as planner for a wonderful trip, home repairs, and more.

Keeps you organized: finances are not easy, and you can quickly become overwhelmed with the process. But when you use a printable budget planner, all your financial information is kept in one place.

Have a monthly plan: a printable budget planner also makes it easier to have a monthly plan for your finances. You can easily see where spending needs to decrease, how much you can save, etc.

1. The Couples Planner

There might not be anything romantic about planning all of your dates with your spouse or partner far in advance, but this couples planner can help you do it anyway. And there are plenty of benefits to being super organized in your relationship. You can make sure you have enough date nights to keep things interesting without spending a ton of money.

2. Bill Planner List

Via MyFrugalHome.com

No matter how organized you try to be, keeping track of all of your bills and subsequent payments can be hard work. Maybe you need help staying on top of your bills to have a better monthly budget. Or, you simply forget to make one of your many credit card payments from time to time. With this organized bill planner, you can keep track of which bills you pay each month.

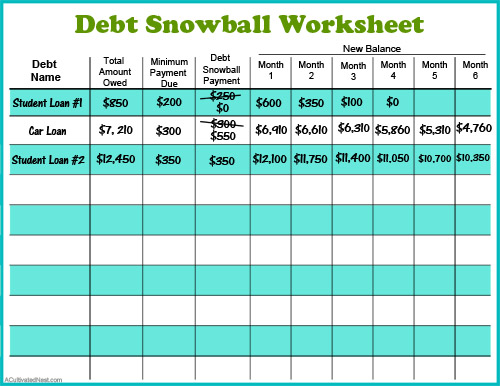

3. Debt Snowball Tracker

This planner offers another way to effectively pay your monthly bills. But instead of simply listing them, you can learn to pay off your bills in a different way. You start by listing your bills in order from the ones which require the least payment to the ones that require the highest. The idea is that you pay off your lowest bills first and gradually work up to paying off all of your bills. Only this way, you won’t be overwhelmed and you can keep it all organized.

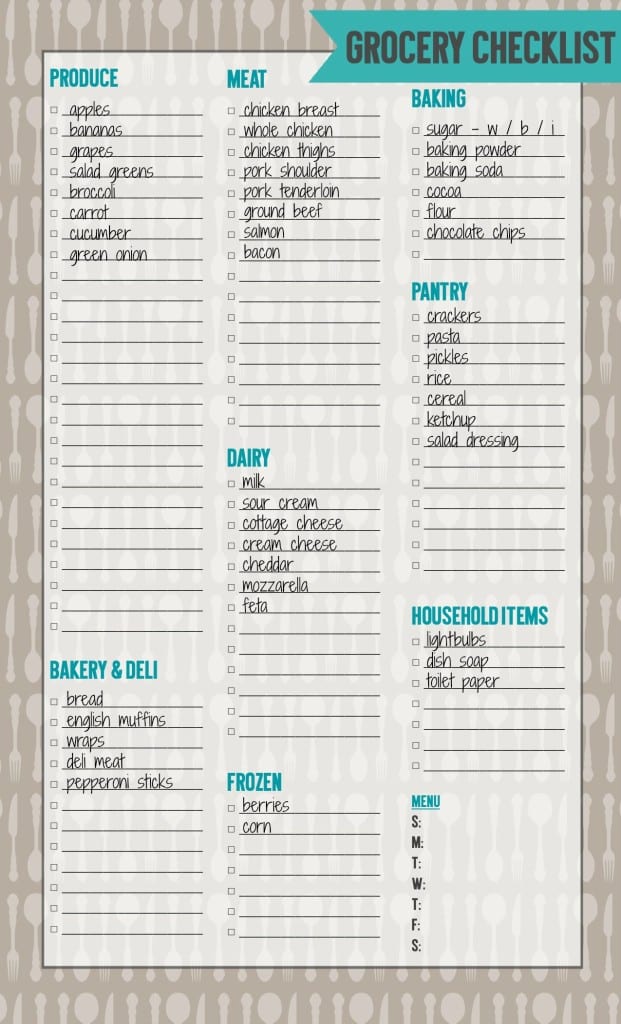

4. Grocery Checklist

Most of the time, budget planners are all about keeping track of your bills. But in this instance, it’s more about keeping track of your grocery budget. A lot of people are guilty of not making a list ahead of time and going to the supermarket, only to spend money on unnecessary items. By keeping on track with a grocery checklist, you can keep your grocery budget where you need it to be without overspending.

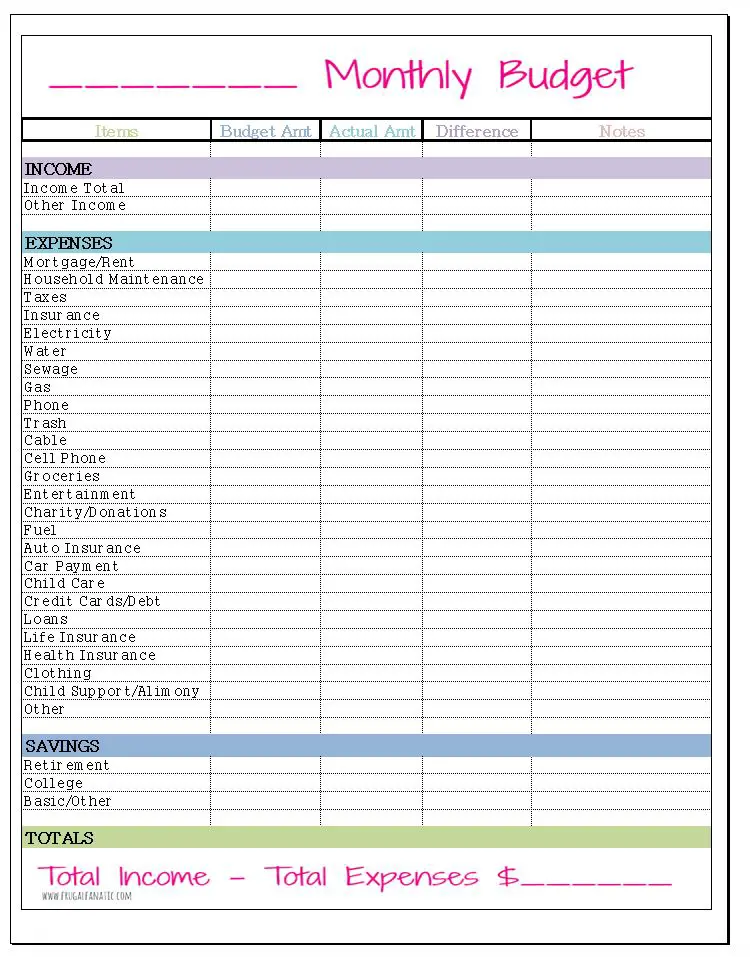

5. Monthly Budget Planner

This monthly budget planner actually encompasses all of your monthly spending, which can sometimes be the goal. With this planner, you can account for bills, mortgage or rent, and even entertainment expenses every month. Regardless of how much money you have to work with, keeping all of your spending in one spot can make a world of difference.

6. Family Budgeting Sheets

This way of budgeting can be a lot to handle, but with multiple family budgeting sheets, your entire family can stay on track. These sheets are meant for a binder to keep them better organized, which can be intimidating for even the most anally organized family. Having an entire binder to rely on for budgeting, however, can keep you more organized than ever.

7. Bill Tracker Planner

Using a bill tracker planner like this one is pretty straightforward. All you have to do is list the bills you need to pay every month, the amount you need to pay, and the date they are due. Then, you check off each month’s box as you pay them. If you are just starting off in strict budgeting, this is the perfect planner to use as a jumping off point.

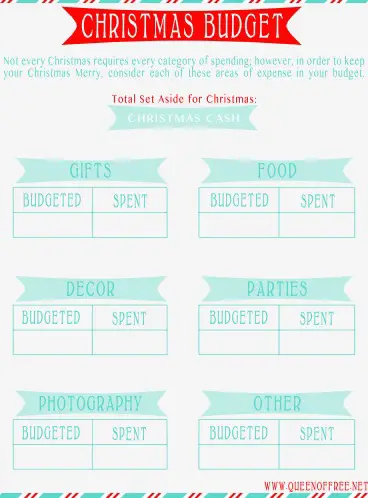

8. Christmas Budget Planner

Via QueenOfFree.net

One thing that can put a glitch in your budgeting is the holiday season. You can budget for incidentals and entertainment as much as you want, but things can get out of whack as soon as you realize you also need to account for Christmas gifts, decorations, and even food. These Christmas budget planners can help you get and stay organized as the holidays approach.

9. Colorful Monthly Budget List

If you want a budget planner that looks a little prettier and is less of a list, this colorful monthly budget list could be the right one for you. Like other ones on this list, it keeps your organized with your monthly budget, bills, and non-essentials. But it’s also organized in a way that may be a little easier to read and understand. If all of your budget sheets look like a simple list or graph, it can get a little boring.

If you prefer to stay organized and on task with other aspects of your life, it only makes sense to be the same way when it comes to budget planning. Not only can these printable budget planners help you get and stay on the right path for saving and spending appropriately, but they can also make for aesthetically pleasing charts to keep out in your home and stay accountable with.