People always want to go to McDonald’s every once in a while. However, even the cheapest items on the menu are expensive, especially when the cost is high. Have you…

Latest Articles

5 of the Best Places To Visit in the US With the Kids

March 11, 2024Family vacations carve out unforgettable moments, from the first enchanting encounter with Mickey Mouse to the shared joy of unhurried days at the beach or vibrant splashes at a water…

Investing in Tomorrow: Making the Most of Education Savings Grants

March 10, 2024Putting money into the education of your child is a strong way to demonstrate your belief in progress—both for yourself and for the country as a whole. Canadian families are…

Does BP Take Apple Pay?

March 8, 2024Apple Pay is accepted at most major gas stations, including BP, Costco, Exxon, and Wawa. Apple Pay works using NFC technology, so most gas stations will display the Pay with…

Does Costco Take EBT?

March 8, 2024EBT cards have been accepted at grocery stores for a long time as a legitimate way to pay for things. EBT cards are accepted at Costco warehouse stores just like…

Does Instacart Take EBT?

March 8, 2024Instacart has experienced huge growth in online grocery shopping in 2020, and as a result, delivery services like Instacart have become the latest trend in the industry. EBT cardholders had…

Does Amazon Take EBT?

March 8, 2024For many people, having an EBT card from the SNAP helps them to have enough money to purchase groceries. And even though many people may not think of Amazon as…

Does Starbucks Take EBT?

March 8, 2024Starbucks is a well-known brand that sells various kinds of coffee. Once, you can only use cash transactions; however, there are now other ways you can make purchases, including using…

The 20 Most Expensive Lego Sets You Can Buy Today

March 8, 2024Legos are a nostalgic part of almost every living adult’s past. Little did we know that the Lego set that we played with as children could be worth thousands of…

Can a Bank Ban You

March 8, 2024For many people, having a bank account is a way to ensure that their money is safe and secure. But for others, having a bank account may be just the…

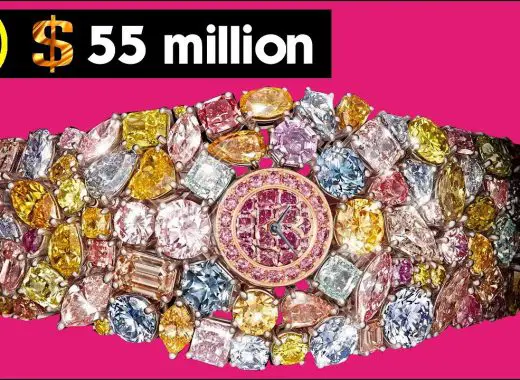

The 30 Most Expensive Watches In The World

March 8, 2024The most expensive watches in the world cost tens of millions of dollars. The Graff Diamonds Hallucination is the most expensive watch at a value of $55 million. Centuries ago,…

Does Wawa Offer Cash Back

March 1, 2024Wawa is a popular convenience store chain that offers customers with a wide variety of products and services. The company has been around for many years, and they have built…

Does Circle K Take Apple Pay?

March 1, 2024Apple Pay is so widely used that it should be considered the default payment methods for most merchants. It is only a matter of time before all merchants accept Apple…

Does Costco Price Match?

March 1, 2024Price matching is a policy implemented in many stores where if a competitor has a lower price than the store you’re buying from is selling the product for, you can…

Can You Play Fantasy Football By Yourself

February 29, 2024Many people who love the game of American football would enjoy the chance to play big league football for real. However, that’s not a realistic scenario for most people. So,…

Does Big Lots Take EBT?

February 29, 2024EBT relies on a vast network of grocery stores to help people who are hungry or who are severely malnourished. Some people try using their EBT cards to purchase things…

How to Choose the Best Bad Credit Loan Company

February 25, 2024Life is filled with many ups and downs. Bad and good patches are a part of life that can never be predicted. All that is in our hands is always…

Does Walmart Accept Google Pay?

February 24, 2024In today’s technologically reliant world, digital payments have become all the rage. People all across the globe prefer to pay simply by tapping their mobile phones or smartwatches on the…

Why Does Costco Checks Your Receipt When You Leave?

February 24, 2024What is Costco? Costco is a warehouse club, similar to Sam’s, that has locations all through the US and some other countries. The retailer charges a fee for its annual…

Best Board Game Tables

February 24, 2024Have you caught the board game bug? You will probably want to get a board game table eventually, then. Sure, you can play on a regular table indefinitely, but a…